Mining ROI Uncovered: Charting the Profit Landscape

The cryptocurrency landscape has transformed from a niche curiosity into a significant player in global finance, with mining at its core. As Bitcoin (BTC), Ethereum (ETH), and myriad altcoins vie for market dominance, understanding the return on investment (ROI) associated with mining activities is essential for investors and hobbyists alike. Each day, new miners set up their operations, yet many remain unaware of the myriad factors that influence their profitability in this volatile environment.

To navigate the winding paths of mining ROI, one must first grasp the fundamental mechanics of how mining works. At its essence, mining is the process of validating and confirming transactions on a blockchain network. For Bitcoin, miners compete to solve complex mathematical puzzles, and the first to succeed receives a block reward—a handsome sum of BTC—as well as fees from transactions included within that block. This reward mechanism incentivizes miners to contribute their computational power to support the network.

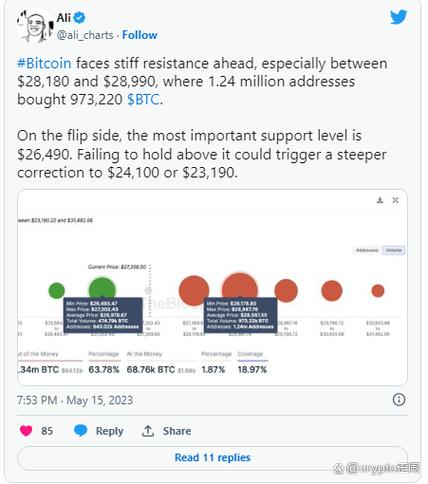

However, the path to profitability isn’t merely paved with block rewards. The vibrant world of cryptocurrencies is characterized by constant fluctuations in exchange rates. For instance, while Bitcoin’s price can soar to new heights, other coins like Dogecoin (DOGE) may witness incredible spikes due to prompted social media trends or celebrity influences. These price movements can severely impact a miner’s ROI, making timing and market awareness paramount for success.

Equally important are the logistical considerations surrounding mining operations. The initial investment in advanced mining rigs and hardware can be substantial. These mining machines require significant power to operate, which entails higher electricity costs. Hence, the profitability of a mining venture is also deeply enmeshed with the local cost of energy. Countries with cheaper energy solutions, such as Iceland or regions in China, have become hotspots for mining farms, where the ROI can be dramatically higher.

Moreover, the hosting of mining machines has emerged as a lucrative business model. Companies provide facilities equipped with robust cooling systems, consistent power supply, and top-tier security for miners who may lack the infrastructure or desire to run their rigs independently. This hosting option simplifies operations for many, allowing customers to focus on the potential rewards while outsourcing the management of their rigs. However, understanding the fees associated with hosting services can further refine estimates of projected ROI.

The mining ecosystem further complicates ROI evaluations with ever-evolving hardware. The rapid pace of technological advancements means that the efficiency of mining rigs is continuously improving, but the mere acquisition of the latest models incurs substantial costs. Anticipating and adapting to these changes is crucial. With ASIC miners dominating the landscape for Bitcoin mining—those specifically designed to process computations at unparalleled speeds—investors often find themselves torn between timely upgrades and maximizing current investments.

Investors should also be wary of the speculative nature of cryptocurrencies as a whole. Just as BTC and ETH experience price surges, they are equally prone to rapid declines. Engaging in mining activities without a solid understanding of market trends can lead to devastating losses, emphasizing the need for comprehensive market analysis alongside mining operations. As traders and miners alike dish out significant capital in pursuit of gains, the question of long-term sustainability weighs heavily on the minds of both beginners and seasoned veterans.

To further augment return on investment, diversification becomes essential. Just as a traditional stock portfolio benefits from a variety of investments across sectors, a miner’s collection should encompass different cryptocurrencies. Mining altcoins can serve as an alternative to the high volatility typically associated with Bitcoin, providing miners with avenues to hedge against downturns in major cryptos. While the market might be laden with risks, it’s crucial to view the potential rewards in a broader contextual framework.

Finally, as this digital frontier continues to expand, the importance of community cannot be overlooked. Engaging with other miners, participating in forums and exchanges, and keeping updated with technological innovations can create a support network that amplifies learning and adaptability within the mining sector. By leveraging collective knowledge and insights, miners can better navigate the financial convolutions and enhance their strategic planning, ultimately leading to superior ROI.

A crucial guide for navigating the volatile world of mining investments. Revealing hidden profit drivers and surprisingly, ecological wins, with pragmatic strategies.